America Last No More: How Trump Will Reclaim the Economy from Biden’s Failures

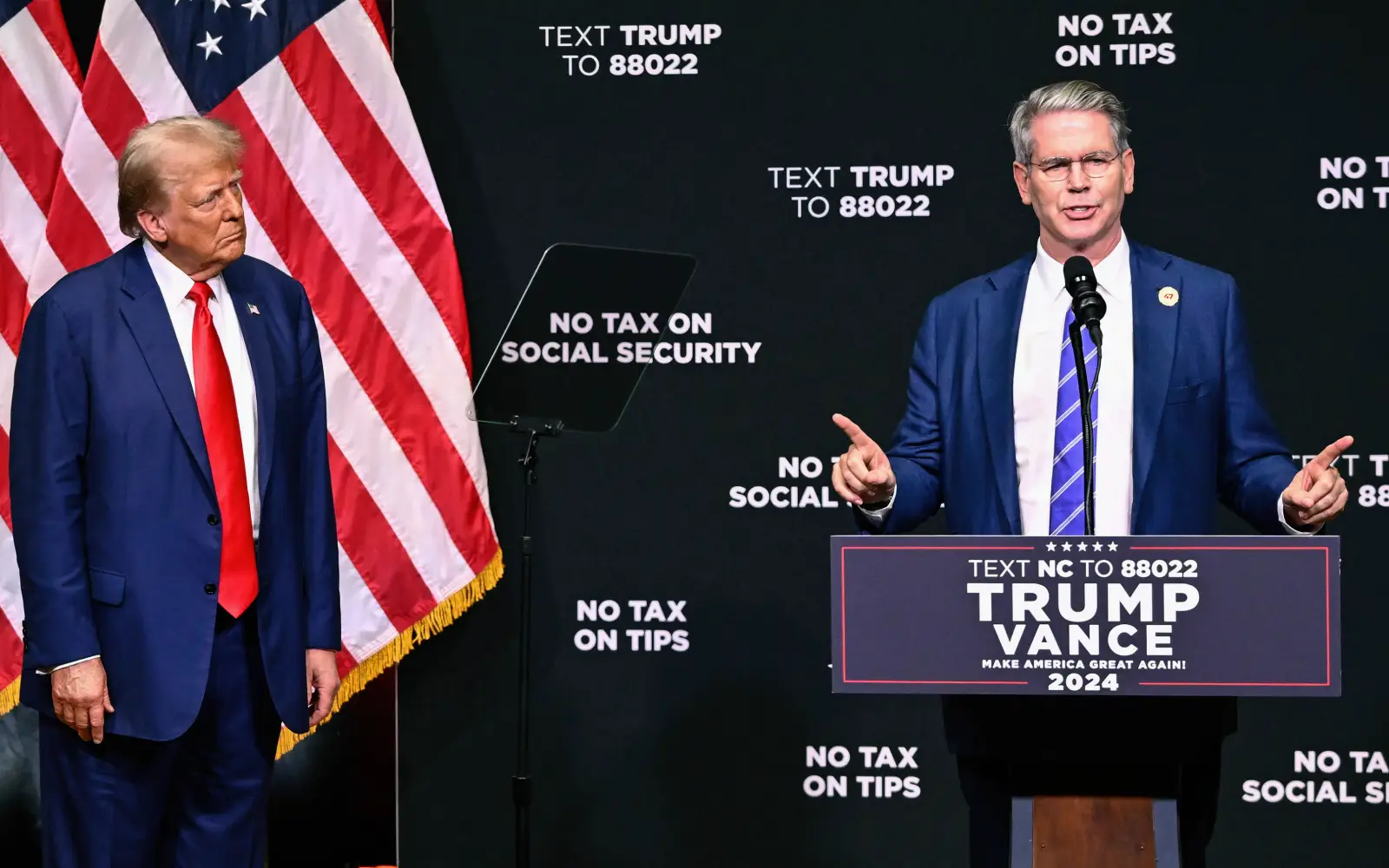

The American economy thrives when driven by innovation, ambition, and self-reliance. In President Trump's first term, these principles flourished—unleashing record job growth, rising wages, and a resurgent private sector. In his second term, Trump now has the mandate to break free from economic stagnation and reclaim America’s role as the engine of global prosperity. The promise is clear: a return to pro-growth policies, lower taxes, deregulation, and a steadfast commitment to empowering businesses and workers. After years of reckless government spending, there is real hope that fiscal discipline and sound monetary policy can restore stability, curb inflation, and make the American Dream more accessible than ever.

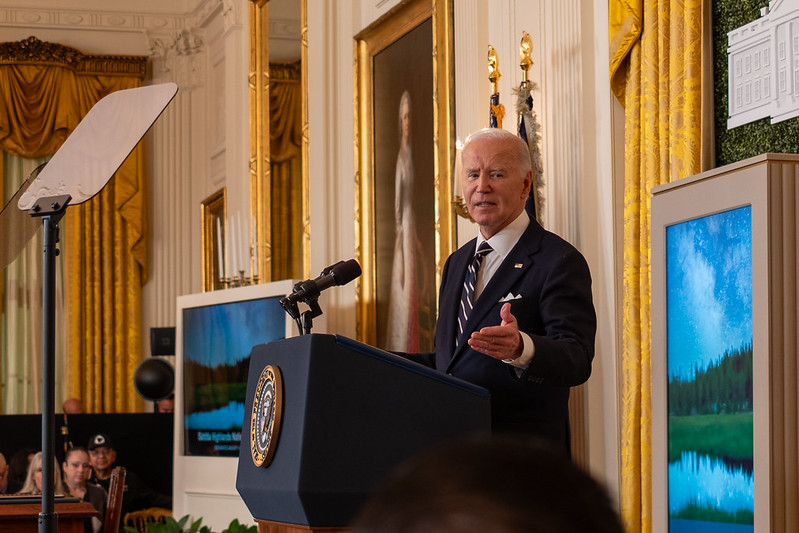

Bidenomics: A Spending Spree with No Endgame

Scott Bessent aptly describes Bidenomics as an unsustainable construct—one that, by definition, cannot last. The administration bloated federal spending from a historical average of 18% of GDP to a staggering 25%, with inflation layering on another 2% drag on growth. The result? A cost-of-living crisis that punishes the bottom 50% of American households. Consumer prices have soared: the CPI jumped 22%, while Jason Trennert’s Common Man Index pegs real inflation at an even more brutal 30–35%. Rent, groceries, and car insurance are all spiraling out of reach. If you own assets, congratulations—your wealth has inflated. If you don’t, you’re absorbing the full weight of these distorted policies.

Democrats peddled the fiction that trillions in spending were essential to “rescue” the economy, but by March 2021, recovery was already underway. The spending spree only deepened the crisis. Debt has soared, and Biden’s only answer? Higher taxes and more European-style entitlements. Meanwhile, the Federal Reserve, slow to react, scrambled to catch up—exacerbating market instability. Inflation spiraled out of control, prompting aggressive interest rate hikes that sent shockwaves through credit markets, crushed small businesses, and locked millions out of homeownership. Mortgage rates surged past 7%, strangling the housing market, while borrowing costs for businesses skyrocketed—stifling investment and job creation. Instead of acting as a stabilizer, the Fed became a chaotic disruptor, amplifying the damage inflicted by Biden’s reckless fiscal policies.

The Rigged Economy: Elites Win, Families Lose

After World War II, 90% of American families saw their children surpass them in earnings. Today, that figure has collapsed to 50%. Instead of real wages rising, Biden’s economic policy mirrors a Marie Antoinette moment: “Let them eat flat screens.” Luxury brands and asset bubbles thrive while the middle class is gutted. Ivy League elites manufacture artificial scarcity in education while posturing about diversity and inclusion—the result is downward mobility disguised as progress.

Under Biden, the IRS has become an aggressive revenue extraction machine, masquerading as a champion of closing “loopholes.” Meanwhile, Social Security holds $2.7 trillion in non-tradable Treasury bonds—essentially government IOUs. Why not transform it into a sovereign wealth fund, ensuring long-term prosperity for all Americans?

At its core, the U.S. has a spending problem, not a revenue problem. Restoring the deficit to 3% of GDP—historically sustainable levels—requires a radical course correction. The Trump model offers a way forward: aggressive deregulation, spending discipline, and the unleashing of private-sector growth. A deleveraging government should clear the path for a leveraging private sector, spurring real job creation over government dependency. Bessent’s proposals align with this vision—championing fiscal responsibility, pro-business policies, and a return to financial freedom.

Crypto, Centralization, and the Fight for Financial Freedom

Biden’s economic policies extend beyond mere overspending—they are about centralization. His administration has embraced digital assets not as tools of financial freedom but as instruments of control and oversight. Trump’s stance on financial liberty, particularly cryptocurrency, underscores a broader commitment to individual sovereignty. As Balaji Srinivasan argues, crypto represents an escape valve—a hedge against inflation and state overreach.

Rebuilding a Nation That Produces

Trump’s economic philosophy is straightforward: create assets, not debt. His policies have sought to lower taxes, slash regulations, and make energy cheap—ensuring real wage growth alongside economic expansion. In contrast, Bidenomics has delivered stagnant wages, mounting credit card debt, and a Federal Reserve forced to counteract reckless fiscal policy with soaring interest rates.

Housing deregulation is key to reviving economic dynamism. Under Biden, excessive zoning laws, environmental restrictions, and bureaucratic red tape have strangled housing supply, making affordability a distant dream. Skyrocketing home prices and limited availability have priced out an entire generation. Trump’s administration is tackling this crisis head-on—rolling back zoning restrictions, streamlining permitting processes, and incentivizing new construction. Slashing unnecessary federal land-use restrictions and cutting bureaucratic barriers for builders will unleash a flood of housing supply, driving down costs and revitalizing communities nationwide.

Energy, Industry, and the Working Class Comeback

Trump’s second-term economic agenda includes expanding energy production to lower costs for consumers and businesses, bringing manufacturing jobs back to the U.S. through strategic tariffs and incentives, and overhauling education to emphasize skilled trades and vocational training. These measures not only spur economic growth but strengthen the American workforce against foreign competition.

Additionally, Trump has signaled a commitment to dismantling bureaucratic agencies that hinder business expansion—including streamlining the FDA approval process for pharmaceuticals and reducing compliance burdens on small businesses. Cutting federal spending through entitlement reform, work requirements for welfare programs, and a renewed push for a balanced budget amendment could restore fiscal stability and reduce national debt.

Unleashing Capital Through Banking Deregulation

A crucial pillar of Trump’s economic vision is banking reform. Under Biden, increased regulatory burdens on regional banks and financial institutions have stifled lending—restricting credit access for small businesses and entrepreneurs. The Trump administration is reversing these constraints, repealing excessive Dodd-Frank provisions that disproportionately harm community banks. Allowing banks to extend more credit and reducing stress-testing requirements for smaller institutions is enabling greater capital flow into the economy, fostering investment and entrepreneurship.

Trump’s pro-business financial reforms also include streamlining the SEC’s regulatory framework to encourage capital formation, rolling back punitive ESG mandates that force corporations into politically motivated investments, and facilitating innovation in fintech and decentralized finance. By prioritizing a freer, more dynamic banking system, the administration is amplifying economic growth while reducing dependence on government intervention.

The Path to Renewal: Growth, Not Redistribution

The path forward is clear: a government that spends within its means, a Federal Reserve that prioritizes monetary stability over political gamesmanship, and a financial system that rewards productive enterprise over speculative excess. America does not need more redistribution—it needs real growth. And that begins with undoing the fiscal and monetary excesses of the Biden years. With the right leadership now in place, President Trump’s economic team is reigniting prosperity—bringing renewed opportunity, innovation, and financial freedom to the American people.

Ziya H. is a Contributor for Liberty Affair. He lives in Warsaw, Poland. Follow him on X @hsnlizi.