Trump vs. the Financial System That Hollowed Out America

The economic tremors shaking Wall Street today are not caused by tariffs, culture wars, or even political gridlock. They are the product of five decades of financialization—a dangerous decoupling of capital markets from the real economy.

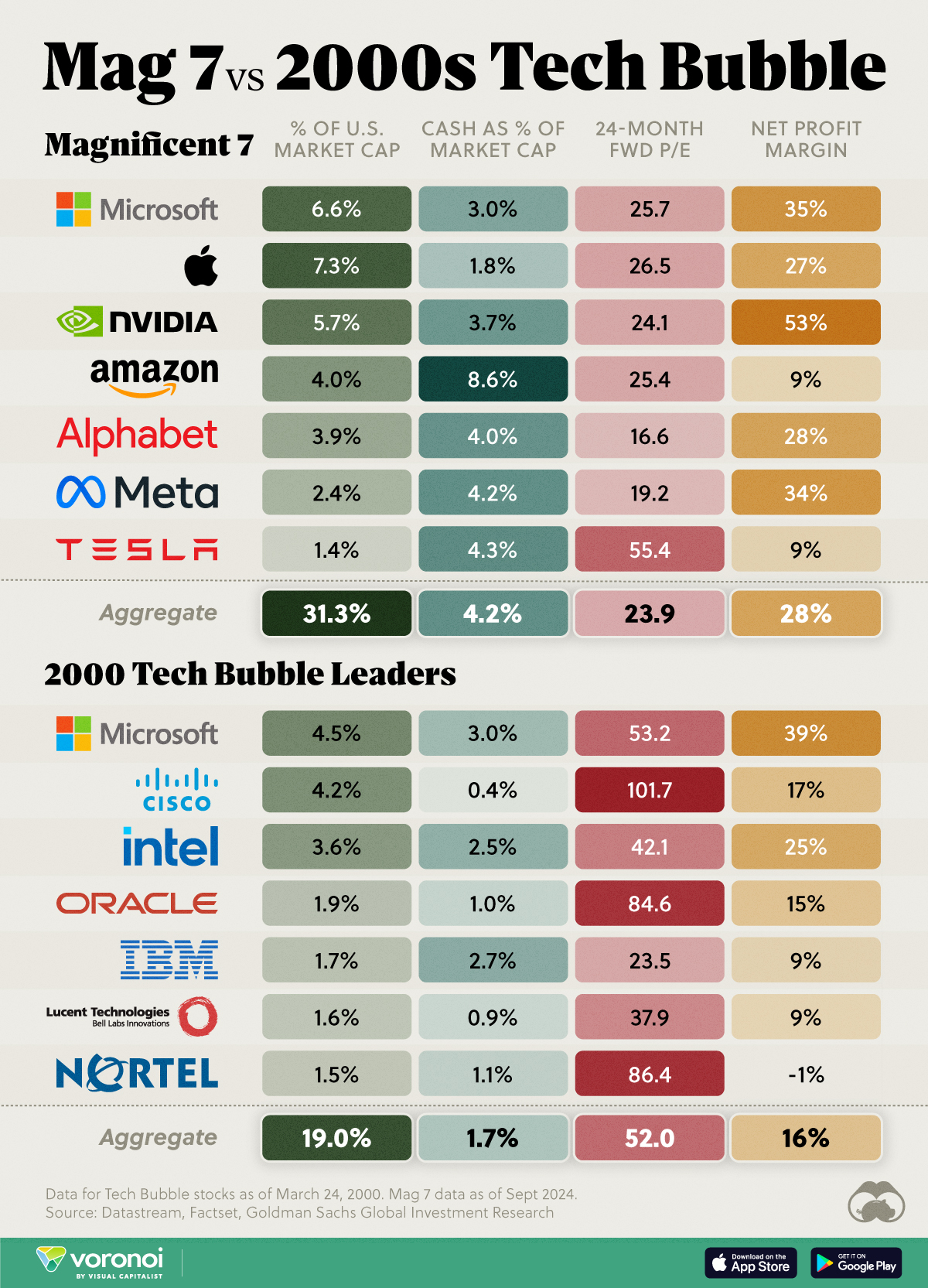

The current freefall in equity prices, especially across the Nasdaq and Dow Jones, is a symptom of this long-festering disease. The popular narrative blames tariff threats and supply chain politics, but the truth runs deeper. The problem is not political turbulence. It is the slow-motion implosion of a bloated, financialized asset bubble, led by the overleveraged valuations of the so-called Magnificent Seven (MAG7).

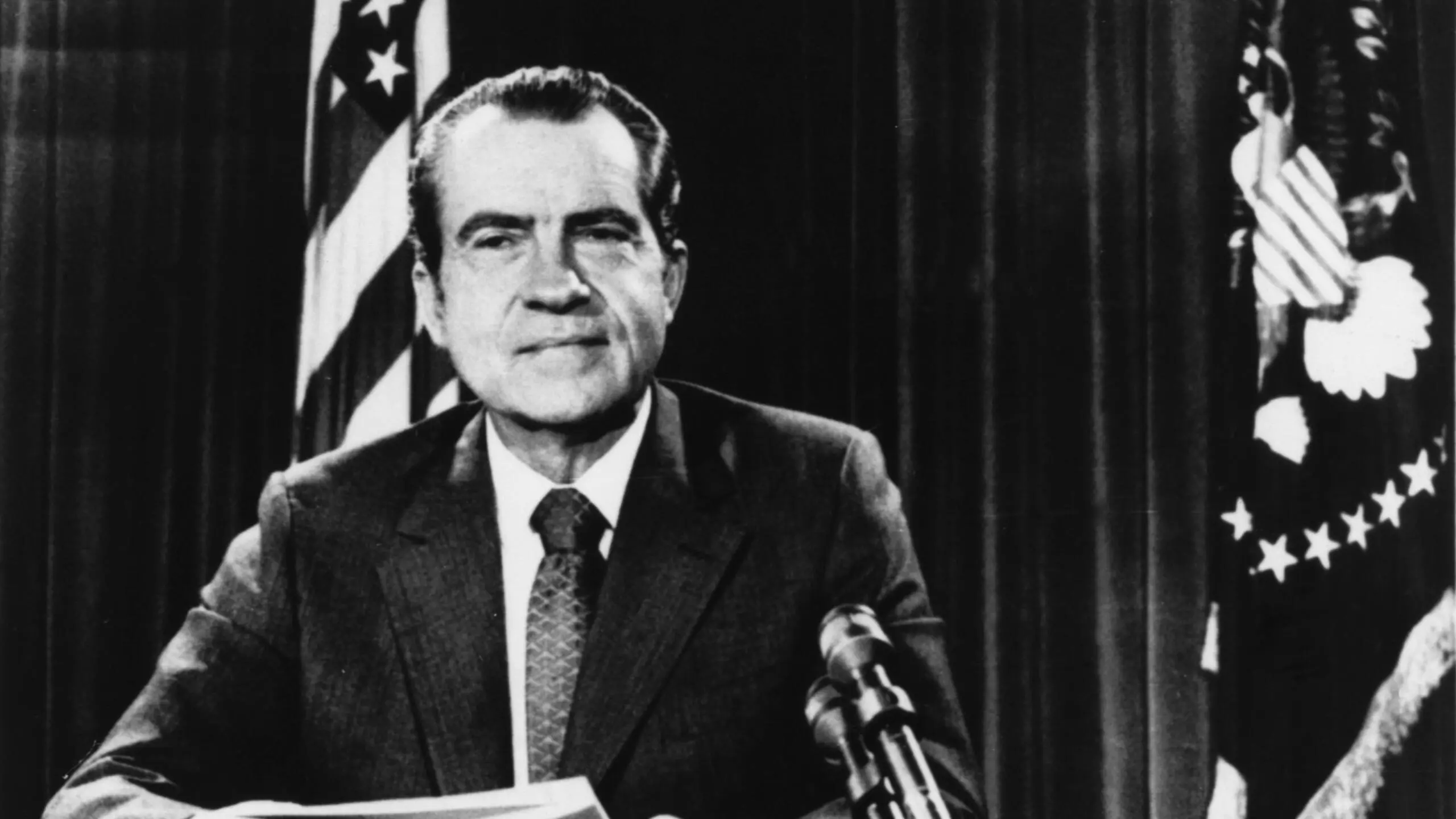

From the Gold Standard to Speculation

To understand the real story, we must go back to 1971, when President Richard Nixon ended the dollar’s convertibility to gold. This wasn’t just a monetary policy adjustment—it was the severing of America’s currency from physical economic discipline. From that moment, the U.S. economy was increasingly driven by credit expansion, asset speculation, and paper profits, not industrial growth or productivity.

The Road to Nowhere: From 2008 to COVID

The 2008 financial crisis was the first true reckoning of this trajectory. Banks had turned homes into poker chips. Wall Street leveraged itself to absurd levels. Real incomes stagnated even as financial wealth ballooned. Yet the response from the Fed and Treasury was more of the same: trillions in liquidity, zero interest rates, and an even deeper commitment to financial markets as the barometer of national health.

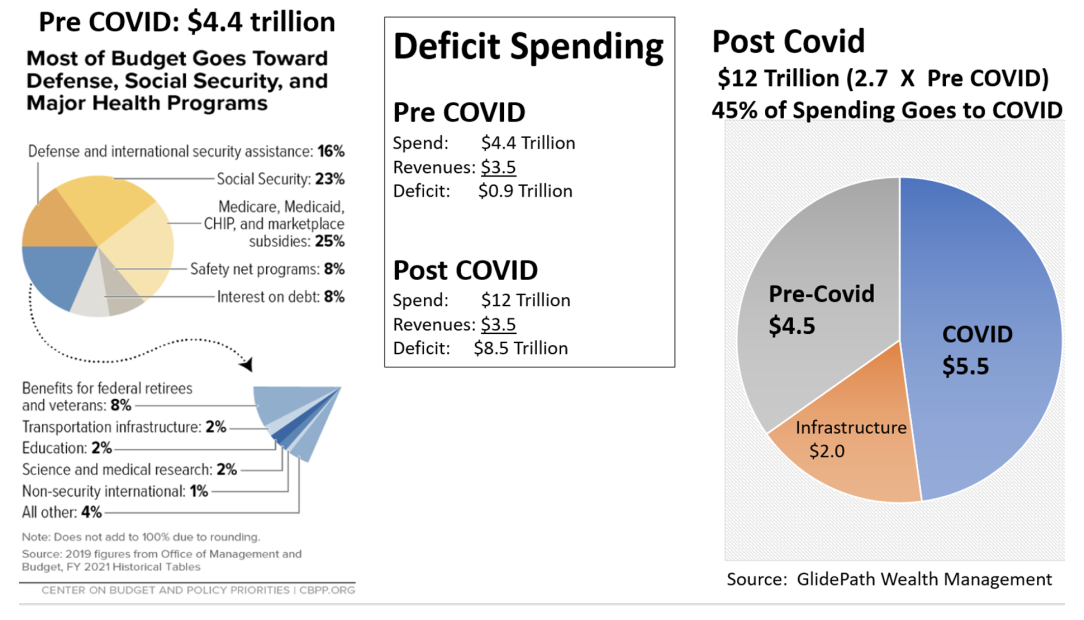

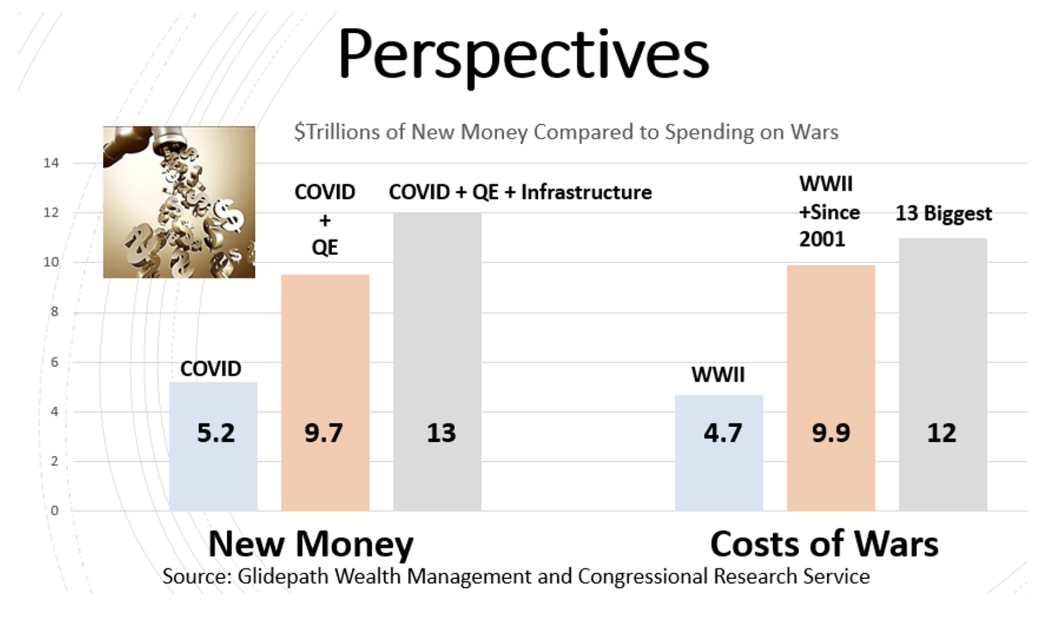

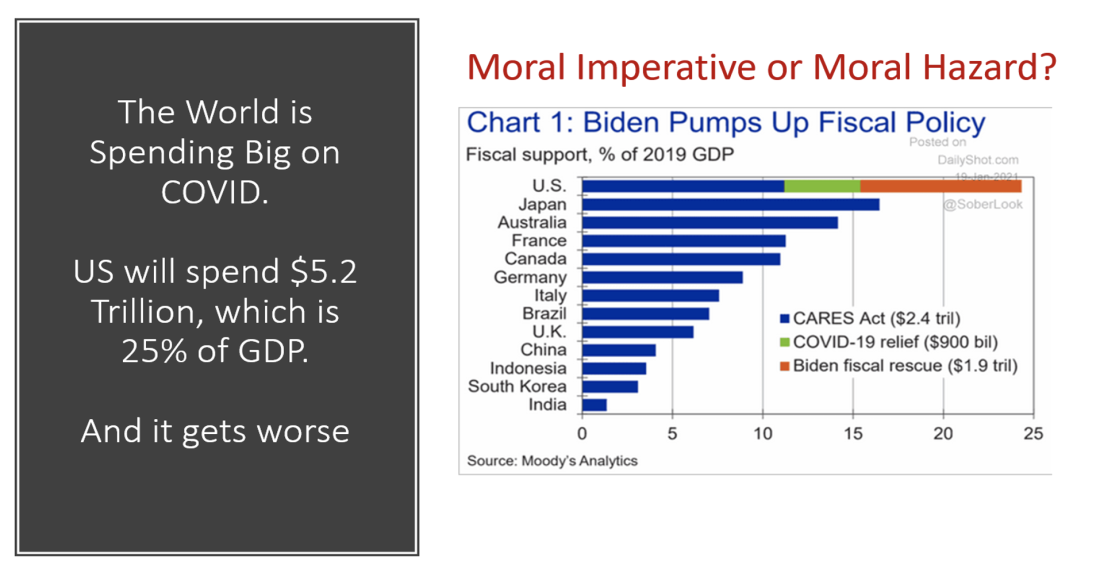

Enter COVID-19, which became the super-spreader of financial distortion. In response to lockdowns and supply shocks, central banks printed money at historic levels. Over $6 trillion flooded the U.S. system. Markets didn’t just recover—they rocketed into the stratosphere. Asset prices detached entirely from earnings, output, and labor force participation. The MAG7—Apple, Microsoft, Amazon, Nvidia, Meta, Alphabet, and Tesla—became trillion-dollar juggernauts, not solely because of innovation or demand, but because the financial system had nowhere else to go.

Let’s be clear: these are exceptional companies. They’ve transformed communications, logistics, entertainment, and computing. They’re not Enron—they create real value. But when the price of future cash flows is distorted by zero interest rates and unchecked speculation, even the best businesses become inflated vessels for misplaced capital.

Indeed, the S&P 500’s equal-weighted index is down roughly 4% annually, revealing that outside of these titans, the broader economy is quietly stagnating. This isn’t a healthy market. It’s a top-heavy pyramid, with most companies flatlining while a handful defy gravity—until they don’t.

A MAG7 Problem, Not a MAGA Problem

It’s popular to blame economic turbulence on populism or tariffs. But the so-called “Trump tariffs” are not the cause of this unwinding. On the contrary, they were the first serious attempt in decades to rebuild the real economy. Trump’s economic team—often maligned by media economists—was one of the most clear-eyed and strategically grounded groups to walk through Washington in a generation.

People forget: it wasn’t just slogans. This team had a doctrine. Led by thinkers like Stephen Miran, Scott Bessent, and Howard Lutnick, the Trump administration understood something that had eluded elite consensus for decades: America cannot remain an economic superpower if it outsources its industrial base, imports its strategic goods, and allows capital to chase margins overseas while hollowing out the middle class at home.

The tariffs on China were not random. They were the first line of defense against an economic model built on currency manipulation, intellectual property theft, and state-subsidized industrial overcapacity. The idea was not to punish consumers, but to begin correcting decades of self-inflicted imbalance.

And the numbers speak for themselves. A 10% tariff doesn’t mean a 10% price hike. History shows that with a 10% tariff, the dollar appreciates by up to 40%. About 4% of the cost gets absorbed by foreign producers, and just 2% by U.S. consumers. When Trump imposed 20% tariffs on key Chinese goods, prices rose by only 0.7%.

This wasn’t protectionism. It was realism.

The CBO Illusion

Meanwhile, the Congressional Budget Office continued its charade, scoring tariffs and industrial policy under static models that assume 1.7 to 1.8% growth for the next ten years. These projections forever underestimate the benefits of domestic reindustrialization. Their economic forecasts read like Enron spreadsheets: neat, linear, and wildly disconnected from reality.

The Trump administration, by contrast, laid out a vision that defied this low-growth fatalism. Rather than piling on government jobs to inflate employment numbers, they pushed for wage gains through labor scarcity. Rather than building a green bubble funded by subsidies, they prioritized energy independence. Rather than channeling capital into financial speculation, they worked to redirect it toward production—real supply chains, real investment, real output.

A Moment of Reckoning

The parallels with 2008 are eerie. Then, too, the numbers looked good—until they didn’t. Today, asset prices are again falling, but not because of any macroeconomic collapse. The collapse is financial in nature. Inflated valuations are coming back to earth, especially in the MAG7. These firms, exceptional as they are, have become the last towers standing in a desert of real economic activity. But even the tallest towers are vulnerable when the ground shifts.

We’ve built a system where stock prices are driven by Fed expectations, not fundamentals. Where GDP can rise even as factories close. Where capital rewards buybacks and debt rather than machines and labor. That model is dying—and Trump’s team saw it coming years ago.

A Prediction Rooted in Realism

The correction underway is brutal, but it is not the end. It is the beginning of a necessary cleansing, of the air coming out of the speculative balloon. And once this purge is complete, there is reason for real optimism—not the manufactured optimism of stimulus-fueled bubbles, but the durable kind born of real economic growth.

Here’s the prediction: in the coming months, the policies put in place—and many more being prepared—by President Trump’s economic team will begin to yield visible results. As financial froth burns off, the real economy will step forward. Factories will reopen. Supply chains will shorten. Wages will rise, not from government mandates, but from renewed competition for labor. Investment will shift from the metaverse back into machine tools.

The seeds were planted during Trump’s first term. The harvest is yet to come. And once the financial detox ends, those policies will look not just wise, but visionary.

This isn’t just a bet on Trump. It’s a bet on gravity.

And gravity, like industrial strength, always wins in the end.

Ziya H. is a Contributor for Liberty Affair. He lives in Warsaw, Poland. Follow him on X: @hsnlizi